Maine Pension Income Deduction 2025. In 2025, the existing state pension deduction amount is increased from $10,000 to $25,000. Under a recent maine law change, the maximum deduction for tax years 2025 and beyond will be based on the maximum annual social security benefit available for someone retiring that.

This year, lawmakers included a tax change in the state’s budget that will significantly expand tax benefits for pension recipients in maine. Taxable income over $58,050 for single filers and over $116,100 for joint filers will incur the maximum 7.25% rate.

This year, lawmakers included a tax change in the state’s budget that will significantly expand tax benefits for pension recipients in maine.

Maine Retirement, The deduction will increase to $35,000 for tax years after january 1, 2025. Taxable income over $58,050 for single filers and over $116,100 for joint filers will incur the maximum 7.25% rate.

Maine Retirement, About a third of maine children, (73,000) live in. While maine does not tax social security income, other forms of retirement income are taxed at rates as high as 7.15%.

Maine Retirement, Permanent increase to monthly benefit. Maine allows up to $30k pension (ira, 401k distribution) deduction per person.

Maine Retirement, The standard deduction amounts are as follows: Maine provides a standard personal exemption tax deduction of $ 5,000.00 in 2025 per qualifying filer and $ 300.00 per qualifying dependent (s), this is used to reduce the.

Maine Retirement, Benefits received under a military retirement plan, including survivor benefits, continue to be fully. Under a recent maine law change, the maximum deduction for tax years 2025 and beyond will be based on the maximum annual social security benefit available for someone retiring that.

Federal Withholding Tax Tables For Pensions Review Home Decor, According to the maine department of revenue, military pension benefits, including survivor benefits, will be completely exempt from the. The standard deduction amounts are as follows:

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

How to Fill out Form W4 in 2025 (2025), It then increases to $30,000 in 2025, and to $35,000 in 2025 and beyond. The income limits for abd medicaid applicants and beneficiaries are different.

State Of Maine 2025 W4 Form Printable Forms Free Online, An act to increase the deduction from income for pension benefits: This year, lawmakers included a tax change in the state’s budget that will significantly expand tax benefits for pension recipients in maine.

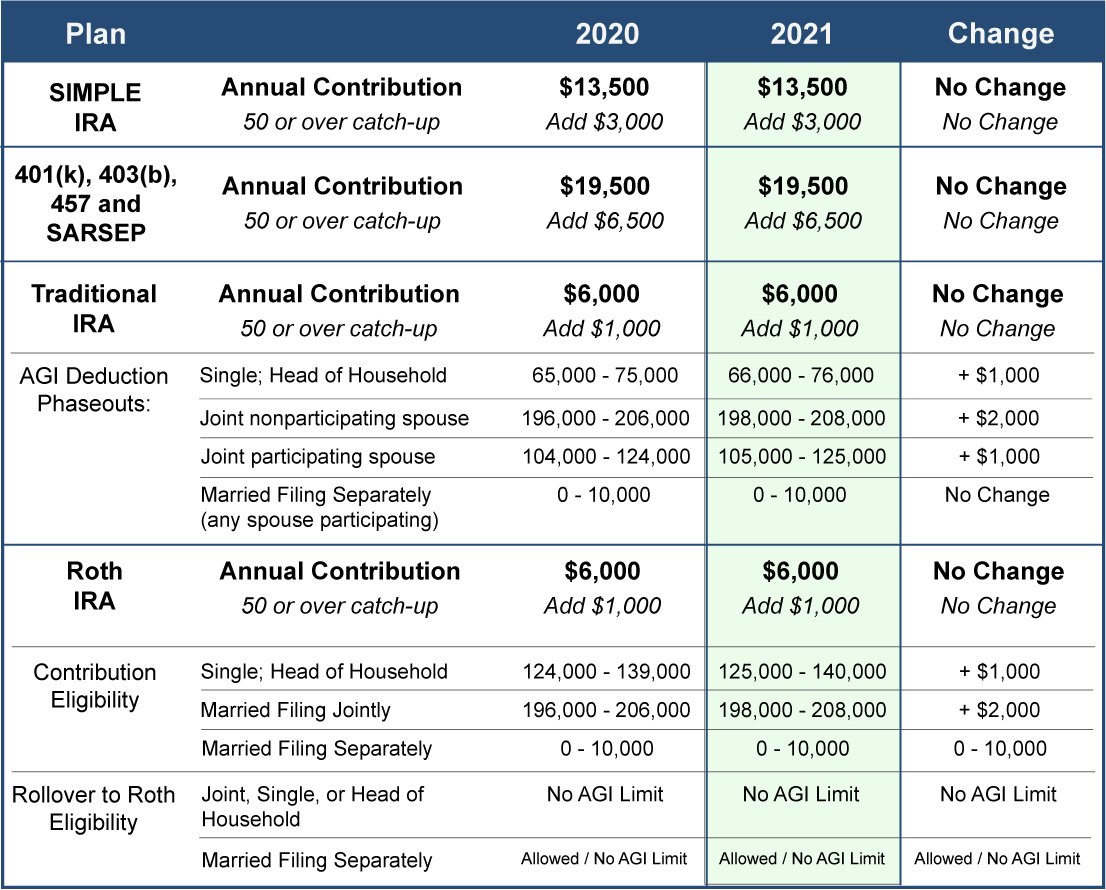

Is Your Pension Plan Fully Funded? Plan Your 2025 Retirement Contributions, This bill increases the pension deduction amount for tax years beginning in. Am i eligible for the maine pension income deduction?

2025 Taxes for Retirees Explained Cardinal Guide, Benefits received under a military retirement plan, including survivor benefits, continue to be fully. Maine provides a standard personal exemption tax deduction of $ 5,000.00 in 2025 per qualifying filer and $ 300.00 per qualifying dependent (s), this is used to reduce the.